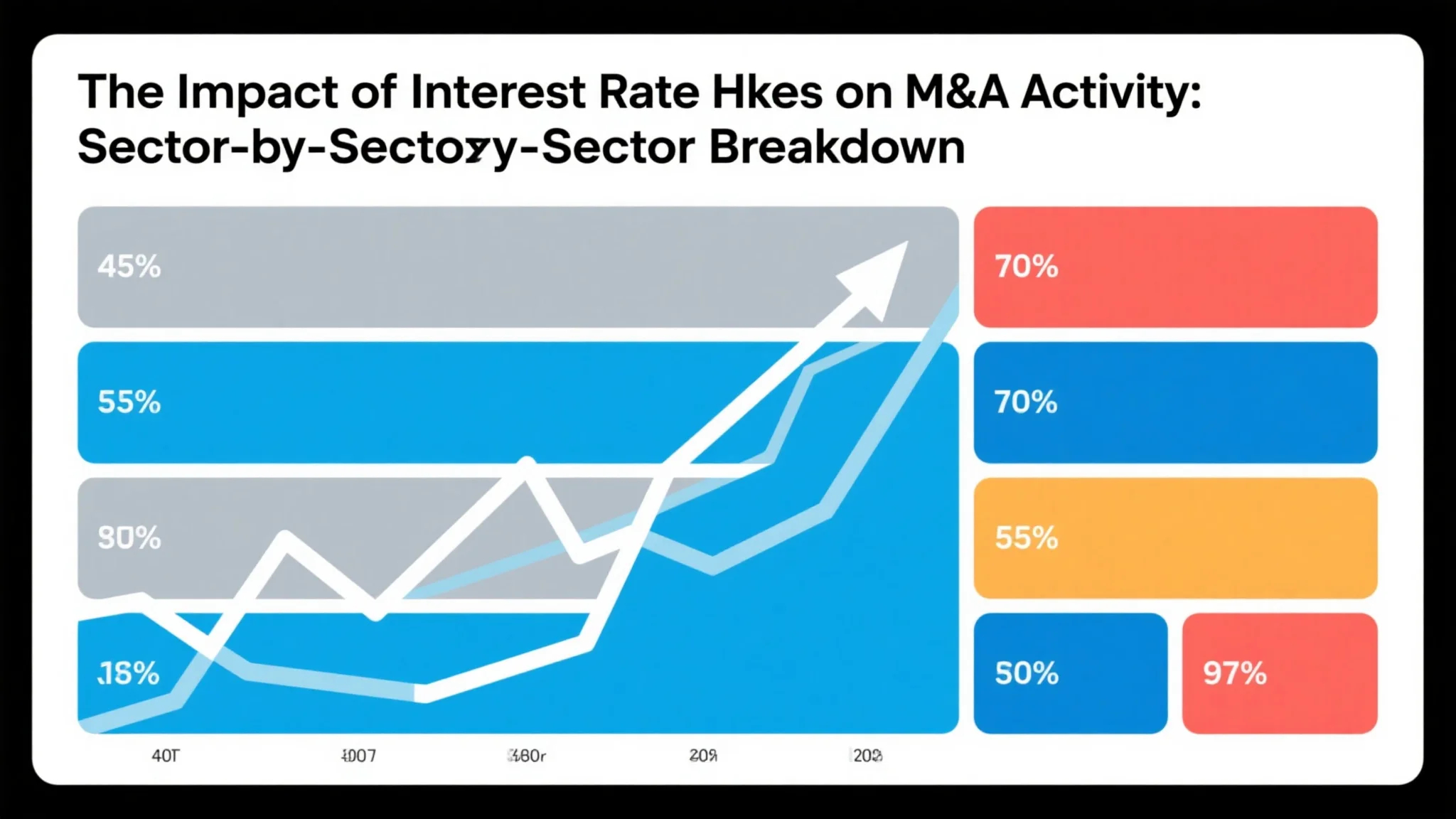

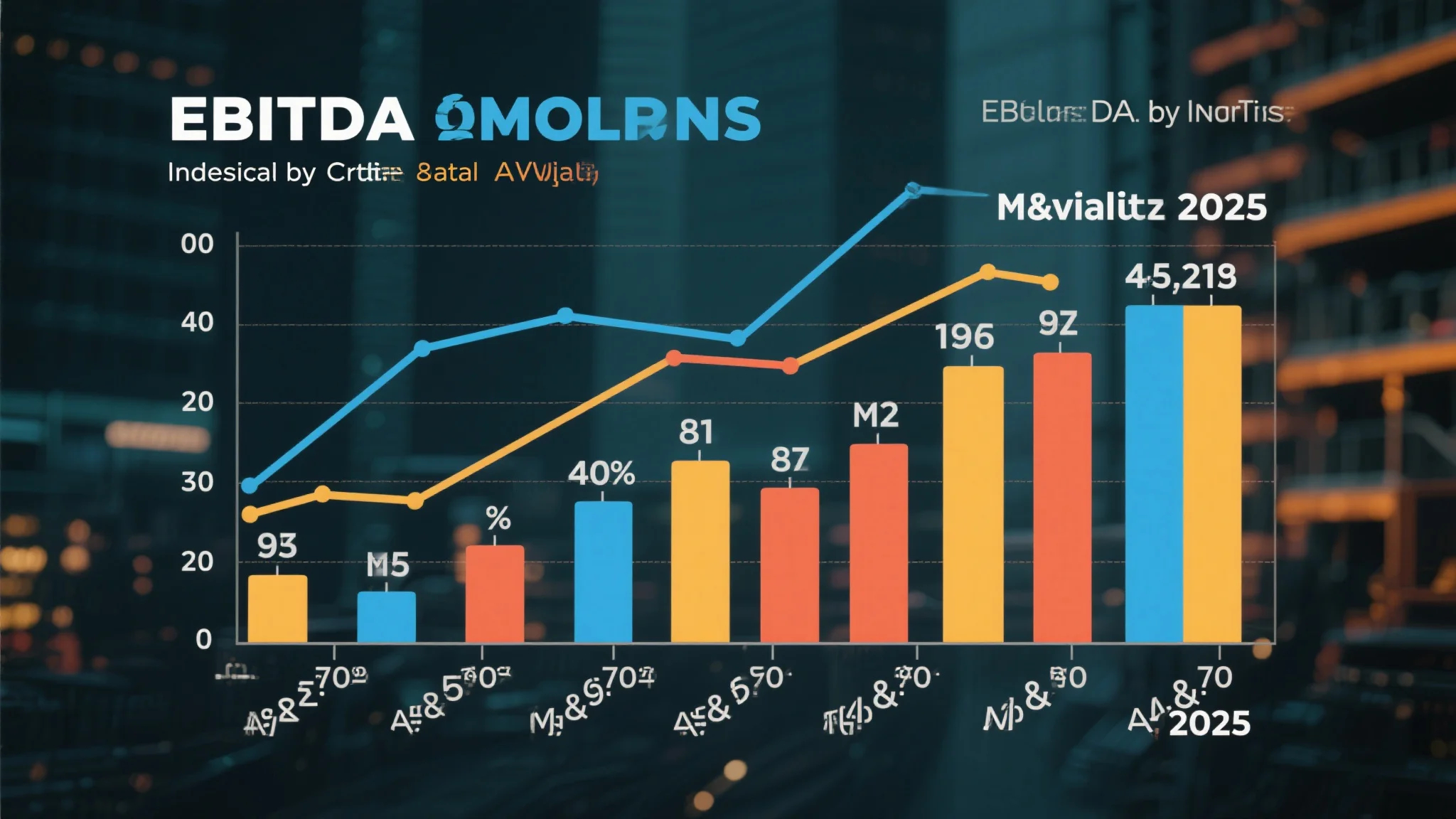

Investment Banking vs. Business Brokers: When to Upgrade for Complex M&A

The financial advisory landscape presents business owners with a critical decision when contemplating mergers and acquisitions: whether to engage a traditional business broker or upgrade to investment banking services. This…